The Russian invasion in Ukraine and the subsequent turmoil in the EU energy markets has created (i) urgent security and economic concerns and (ii) medium-term forces which are redrawing the European energy map.

In this environment, Greece finds itself exposed to rising energy prices due to significant import dependency (about 3/4 of energy consumption vs 1/2 in the EU). The additional cost to the economy is estimated at c. 10% of GDP (so far largely counterbalanced by fiscal measures and positive economic momentum), with 2/3 affecting the business sector and 1/3 burdening households.

Natural gas stands out as the key risk, in view of the imminent threat of a sudden halt in Russian imports (covering c. 40% of Greek natural gas imports but only 9% of the country’s total energy needs). Emergency plans, focusing on re-starting the operation of lignite plants and finding alternative suppliers of liquified natural gas, appear sufficient to cover domestic demand during this winter.

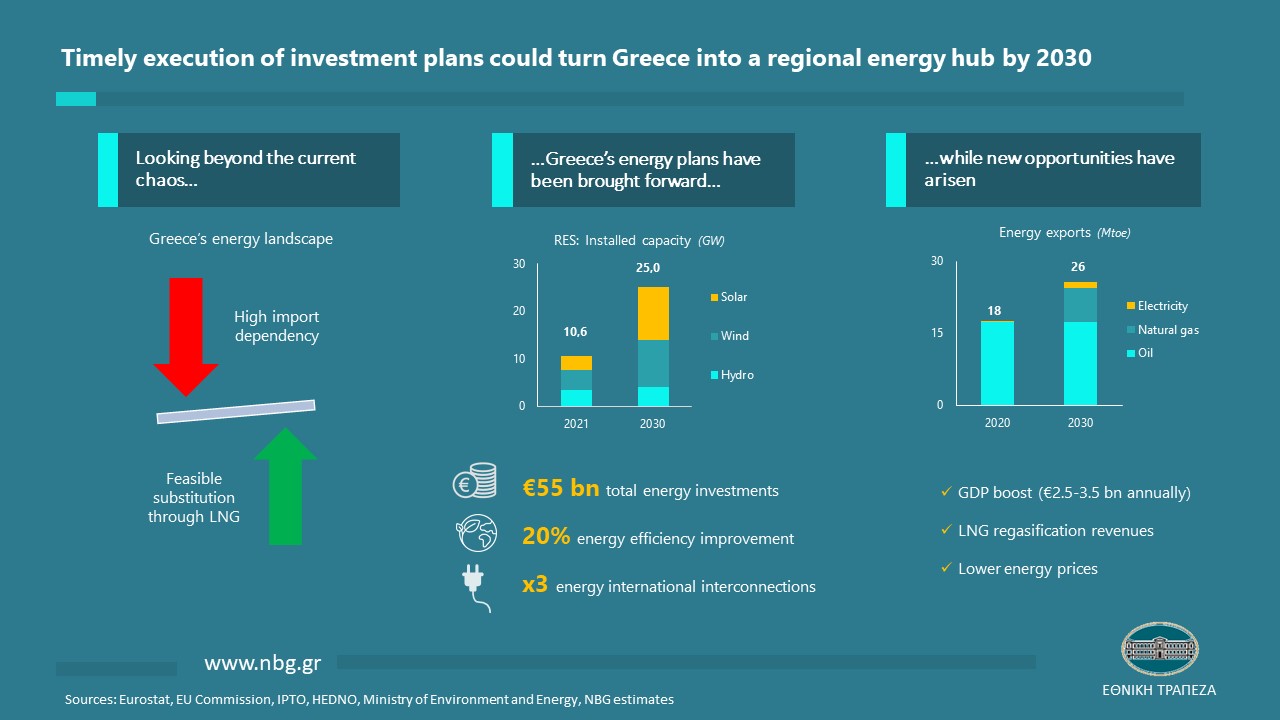

Looking beyond the current chaos, Greece’s energy plans have been brought forward, while new opportunities have arisen. By 2030:

- Overall, domestic demand for energy will rise only slightly by the end of the decade as energy intensity is projected to decline by 20% by the end of the decade, reflecting end-use transformation through both energy efficiency initiatives (e.g. green buildings) and increased electrification (e.g. electric vehicles).

- The domestically produced supply of energy will comprise solely RES, as lignite will be phased out by 2028. RES production capacity will increase by c.15GW, along with c.3.5-5GW of storage capacity to counterbalance the supply volatility of RES. This will allow Greece to meet the new target of 70% RES penetration in the electricity mix by 2030 (vs a previous one of c.60%), as well as electricity covering 33% of energy consumption (from 28% currently). As a result of those investments, fossil fuel’s share in domestic energy consumption (lignite and oil) will decline from 57% to 39%. With existing RES investment projects satisfying comfortably these targets, the Plan’s realization relies mainly on rapid licensing procedures and electricity grid expansion. Indeed, Greece will produce almost ½ of its total energy needs by 2030 (compared with ¼ currently), all comprising green energy.

- Stronger international connectivity is also planned, both in electricity and natural gas. Electricity interconnection capacity will almost triple, (i) to support RES supply volatility and (ii) to exploit opportunities to operate as a transit country for green electricity between South Med countries (Egypt-Israel) and Europe. Though the share of natural gas in domestic energy consumption will remain broadly unchanged at 18-19%, new LNG terminals and planned natural gas interconnections, mainly with SE Europe (tripling both import and export capacity), are sufficient to allow Greece to play a key role as a regional natural gas hub (covering c.½ of SE Europe’s needs), with total energy exports 1.7 times its own total consumption.

The supply-side transformation (amounting to total investments of c. €35 bn up to 2030), along with the beneficial effects of energy efficiency investments (c. €20 bn), will cut back Greek net energy imports by c. €2.5-3.5 bn (i.e. -15-20%). Additional fees could arise from the regasification service of LNG terminals (concerning exports) and from the transit services of natural gas pipelines. Note that these gains underestimate the economy-wide effect as households and enterprises will have the advantage of lower electricity prices.

Infographic: