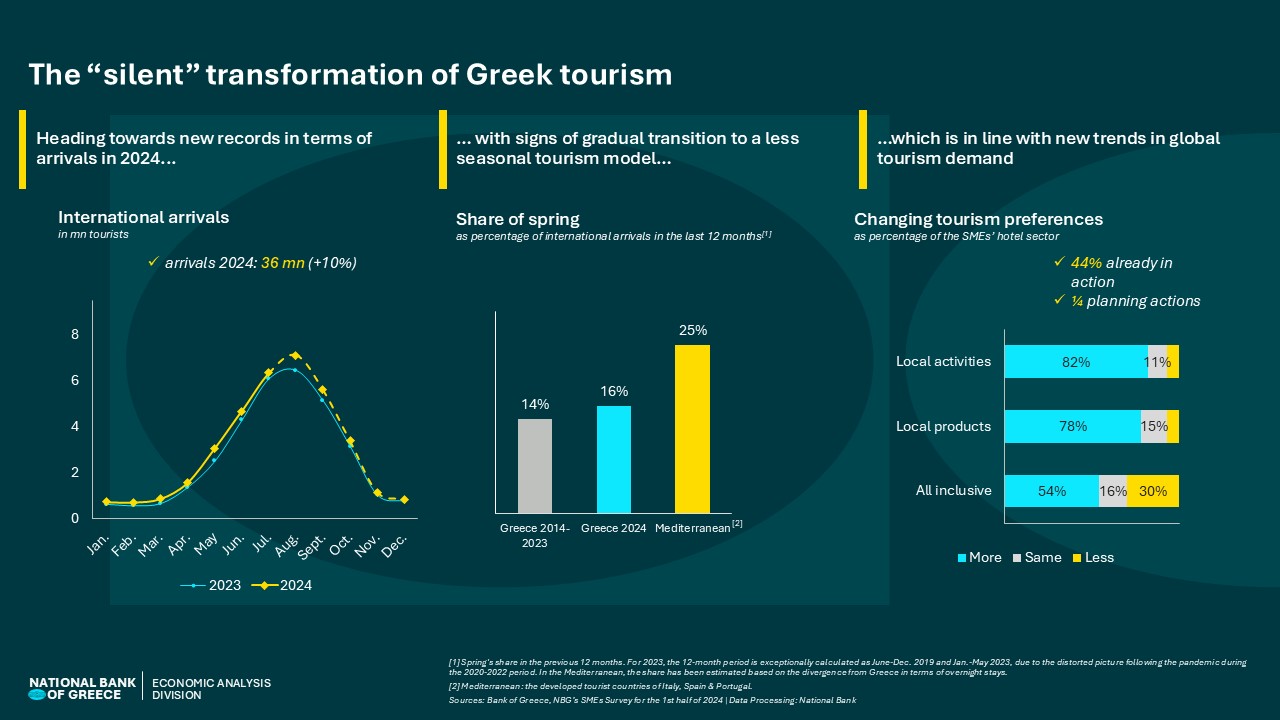

The year 2024 is expected to become a new milestone for Greek tourism, as tourist arrivals are expected to reach around 36 million (+10% annual growth), showing a distinctly different performance between the two halves of the year:

- In the 1st half, exceptional performance was recorded (+16%), with spring leading the way (+21%).

- In the second half, we estimate that positive momentum will continue at a slightly lower pace (+8%), but still play a key role in the annual result due to high seasonality. Supporting to these expectations are (i) the initial data from the July-August period (+6-7%) and (ii) the trends of leading indicators for autumn (+9%).

Beyond record performance, what defines the year is the clear trend of reduced seasonality, driven by spring, which increased its share in arrivals by 2 percentage points within the last twelve months (to 16% from 14% in 2023), reaching a historic seasonal high (+1 million arrivals compared to spring 2023). Notably, this emerging trend has the potential to be sustained in the mid-term, as the acceleration in spring was broadly supported (i) by both air and road arrivals, as well as (ii) across key markets (with a growth range of 22-24%). At this point, it’s worth noting that the momentum is more limited concerning the other shoulder period (autumn), as its share in annual performance is close to the Mediterranean average (25%).

The emerging changes in tourist preferences are consistent with the transition to a new, less seasonal tourism model, as highlighted by the NBG survey on Greek hotel SMEs. A key finding of the survey is the increased interest of tourists in local activities and products, in contrast to declining interest in all-inclusive services associated with mass summer tourism.

From this perspective, it is highly encouraging that 44% of the segment is already taking actions to adapt to the new needs, while an additional 25% have relevant plans. While, understandably, at these initial stages, larger hotels have moved faster to meet new demand standards, in line with their wider strategic growth orientation, our survey also identifies parameters that smaller hotels can leverage to meet the upcoming demands. Specifically, smaller hotels appear to have closer ties with both their customers and their staff—factors that align with the new global demand trends. However, the crucial catalyst that could make the difference, by activating their comparative advantages, is the development of cooperation with local businesses.

Such initiatives for the transformation of Greek tourism have the potential to be strengthened (especially for smaller hotels that are just starting to embrace this trend), as:

- The first signs from relevant actions point to high returns.

- There is still significant room for further improvement in seasonality, particularly in the spring period (as Greece is still lagging considerably the seasonal profile of other Mediterranean destinations).

See the infographic: