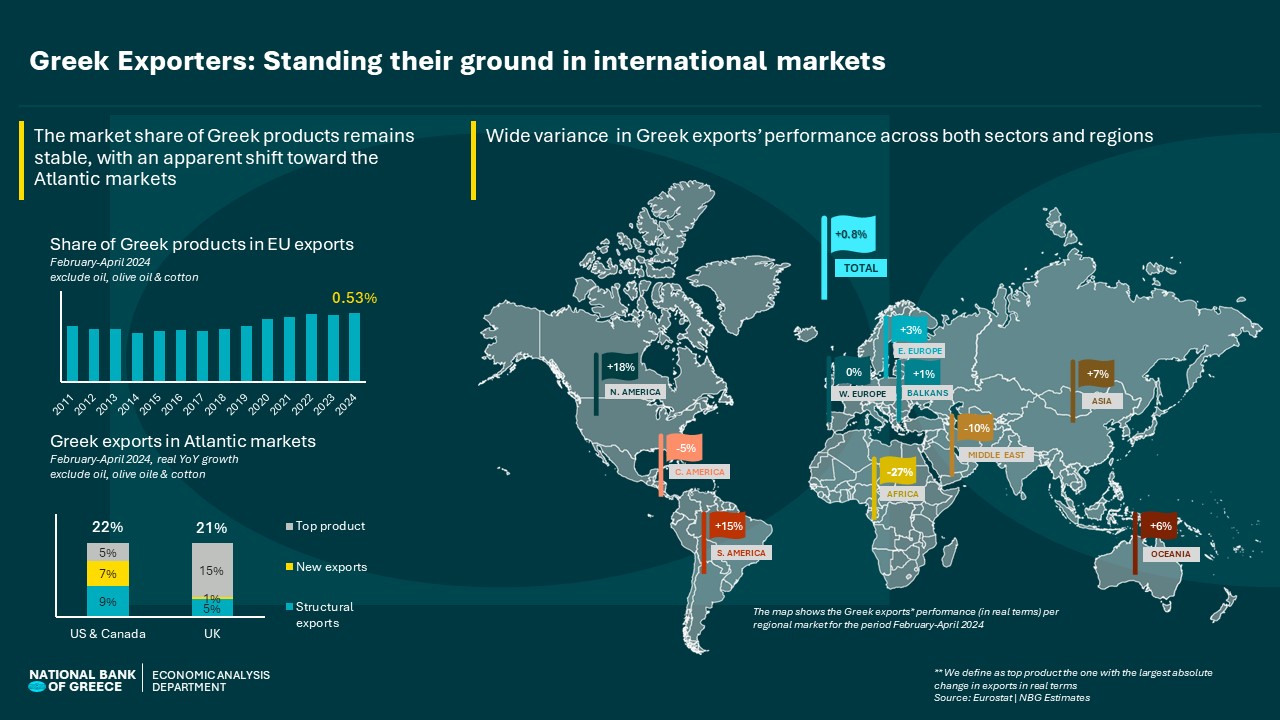

Greek exports appeared stagnant during the February-April 2024 period, with a modest growth of +0.8% in real terms. However, this performance conceals the intense effort exporters have made to preserve the market share gains achieved in recent years. In the current fluid economic environment, it is still too early to draw definitive conclusions about sectoral trends. Nevertheless, Greek exporters should be credited for maintaining their market positions, largely by adopting aggressive strategies focused on competitive pricing.

When examining regional market performance, the results are mixed:

- The larger European markets (Western Europe, the Balkans, and Eastern Europe), which account for 80% of Greek exports, showed relative stability, with annual growth ranging from 0% to 3% in real terms.

- Conversely, smaller markets experienced significant fluctuations. Notably, America showed strong growth, while the Middle East and Africa saw a double-digit decline.

A notable development is the strategic shift toward Atlantic markets, particularly North America and the UK, where Greek exports surged by nearly 20% in real terms. This trend merits further analysis in the coming months, as early data suggest it may be driven by (i) structural factors, possibly related to difficulties in the Suez Canal trade route, and (ii) individual efforts to expand market penetration in these regions.

However, the initial data for May-June 2024 show a decline in exports, with performance deteriorating to -8.2% from -1.1% year-on-year in the January-April period. As a result, the first half of 2024 is expected to be challenging for Greek exports, with an estimated decline of -3.6% in real terms.

Looking ahead to the second semester, although weak export dynamics are expected, similar to those in the first semester (-1.6 percentage points), several factors may support a rebound in performance:

- The negative base effect from the first semester is expected to reverse, potentially adding around 2.0 percentage points to export growth.

- The recovery of olive oil and cotton production to normal levels could further boost performance by 2.5 percentage points, pushing annual growth to around +3% in real terms.

Despite these positive prospects, 2024 remains a year of considerable challenges. Geopolitical instability and political developments in the EU and US could unexpectedly disrupt Greek exports. Additionally, climate change continues to pose a serious threat to agricultural production, a key sector for Greek exports, as food products account for one-quarter of total exports.

See the infographic: