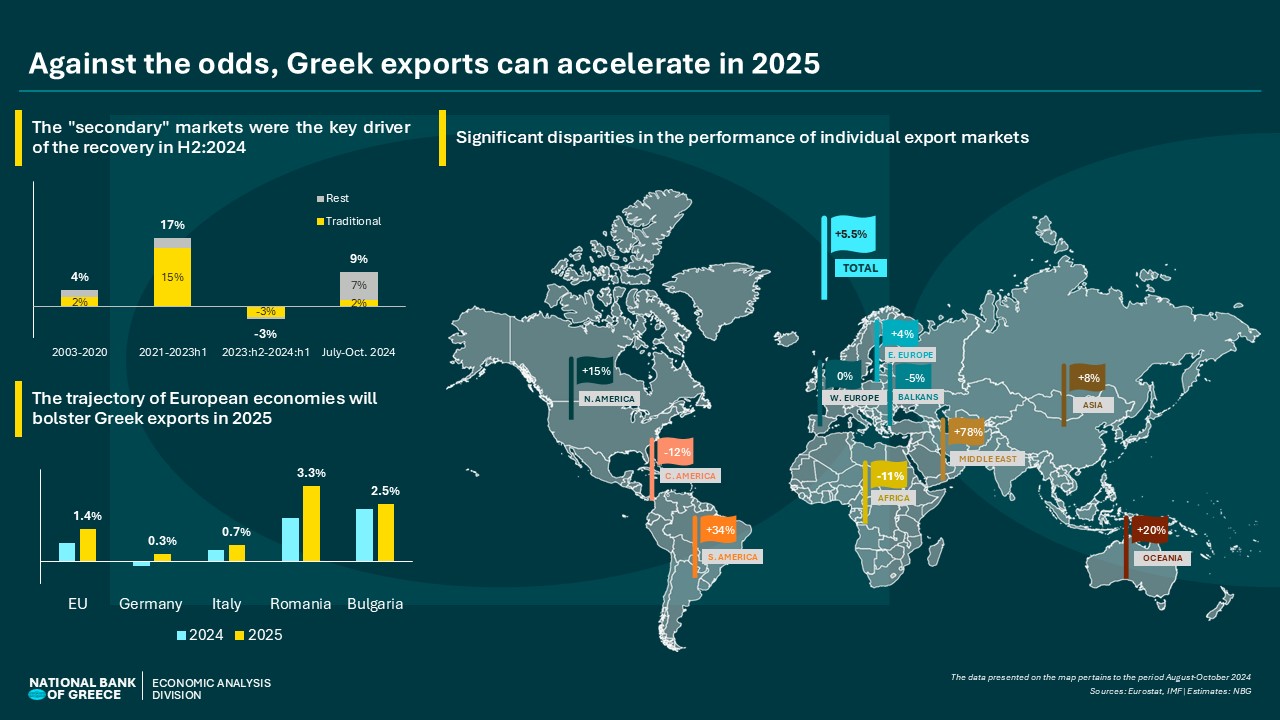

Greek exports experienced a strong recovery in the August-October quarter, with a 5.5% increase (YoY in deflated terms), following a weak nine-month period (-6.3%). However, upon closer examination, this upward trend proves to be fragile, as it lacks support from our 'traditional' markets. Specifically, the markets of Western Europe and the Balkans (accounting for ⅔ of Greek exports), typically the ones driving the trend, moved downward, limiting the overall trend by 1 percentage point. As a result, the boost came from "secondary" markets, which contributed 6.5 percentage points to export growth, with half of this increase largely attributed to one-off metal orders from the Middle East (likely for energy projects in the region). In this context, the U.S. stands out as an increasingly important destination for Greek products over the last three years, registering an average annual increase of 7% in deflated terms – more than three times the performance of other markets (2%) – however, this dynamic effort by Greek exporters may be at risk due to the adoption of aggressive trade policies.

Beyond these concerns, we identify two positive elements in the current juncture:

- The food sector had a positive impact, contributing 1.5 percentage points, with traditional Greek products such as feta cheese, yogurt, olive oil, and olives accounting for more than ¾ of the growth.

- The share of Greek products in European exports reached a 15-year high (0.55% compared to 0.51% in the corresponding period of 2023).

Overall, based on early indications for the last two months of the year, exports in 2024 recorded a decline of around 1% (in deflated terms), as the recovery in the second half of the year (+5%) nearly offset the losses in the first semester (-7%).

Looking ahead, the outlook for 2025 is positive, as:

- The European economy is expected to achieve a more dynamic recovery, which could drive an increase of imports by 2.2% (after two years of decline). On a broader level, international demand is expected to remain healthy, with an estimated 3% increase in global trade volume (compared to 2.7% in 2024), while Greek export orders index continue to stand out positively compared to our European competitors.

- Additionally, the restoration of olive oil production to 2023 levels will boost export performance by 1 percentage point, offsetting the corresponding loss caused by low production in 2024.

Given these circumstances, Greek exports in 2025 could achieve a performance of around 3%-4% (in deflated terms). However, global uncertainty significantly increases the ex-post volatility in our estimates, creating a substantial risk of lower performance. Beyond the burden on the strong performance of Greek exports to the U.S., the main issue is that the EU is at the centre of the “trade storm”, as it maintains a high trade surplus over the U.S. (particularly Germany and Italy, which are important export partners for Greece). Furthermore, a potential trade war could lead to a broad slowdown in global trade, as well as significant reshuffling of market shares among major players.

See the infographic: