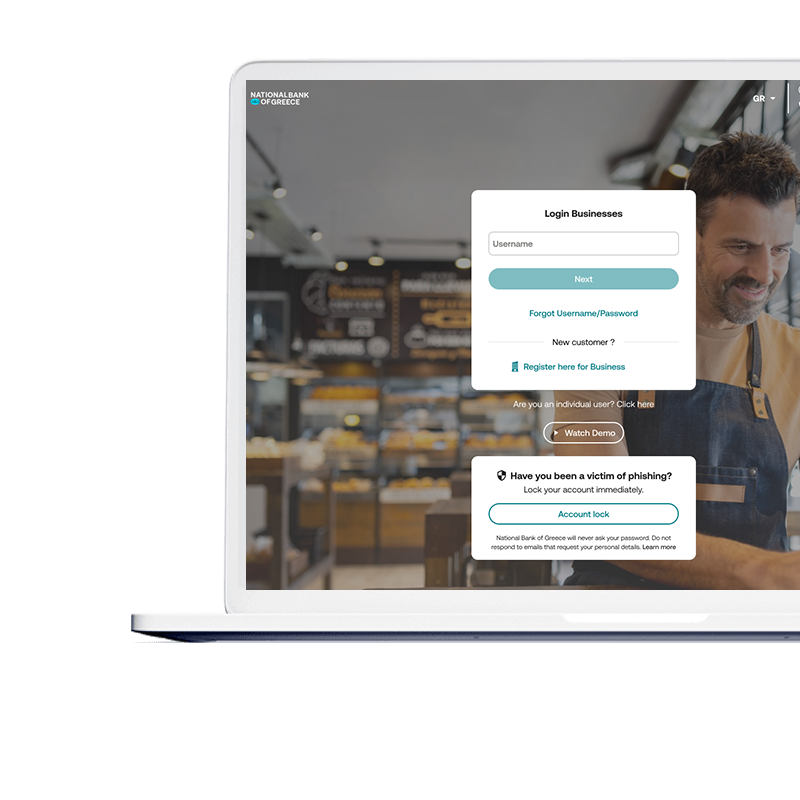

The new Internet Banking for your business is now live.

A new interface, a better Internet Banking experience!

Dashboard – I have a complete view of my business

Accounts – I manage the accounts

Loans – I check and repay loans

Transactions – I monitor all transactions

Approvals – I approve pending requests

Help Center – I find answers to my questions

I want Digital Banking for my business

Do you want more information?

The available features you can find in the new NBG Business Internet Banking environment are:

Approvals: You can view and approve all transactions that have been registered for action by you, as well as those you have submitted for approval.

Transactions: You can find information about your transactions (individual, bulk, future, and ETHNOfiles), as well as initiate a new transfer or payment process.

Products: From the products section, you can find all the information about your accounts and loans, as well as initiate related processes such as account opening and debt repayment.

Profile: From the profile section, you can find all information related to company management (details, limits, and authorization) and user management (access and limits, settings, display, and notification settings). You can also manage your connections with other users (connected IDs) and other banks (aggregation), as well as deactivate your account.

Notifications: You can view all notifications you have received, with a display that separates general notifications from transaction-related ones.

Help: From this section, you can find all the information related to your service store, communication methods for support, as well as answers to potential questions from the FAQs section.

To switch between the new and old NBG Business Internet Banking you can click on the "Transition" option without having to re-enter your passwords.

Similarly, you will be automatically redirected to the previous version if a task, product or service is temporarily unavailable.

You can connect a new user to your profile from the menu within the 'Profile' section, then 'Manage Linked IDs'. On this page, by clicking 'Link New Profile', you will be directed to a login screen where you need to enter the name and password of the user you want to connect to your profile.

Once you successfully complete the linking process, you will be able to view the basic details of your newly linked user on this page, as well as link additional users by following the same procedure.

In the new NBG Business Internet Banking, you can get a comprehensive view of all your products and those of your linked users. On the Homepage, you will find a summary of the total amounts of your accounts and loans, with the option to view the distribution of the totals per linked user. Additionally, from the Homepage, you can select any linked user to see a more detailed view of the products they hold, such as checking accounts, term deposits, and loans.

From the 'Products' section, you can activate the button to display linked users to view all the accounts and loans of your linked users in the list of your products. The products of linked users will appear with the distinct symbol of the connected ID, and for each product, you will be able to see the user it belongs to and the company they are associated with.

Once you have logged in to NBG Business Internet Banking, you will be able to quickly find important information about your business and profile from the Homepage.

In the 'Business Information' section, you can stay informed about the expiration status of the four most important items for maintaining an updated business profile: Insurance validity, Profile status, Declaration of the beneficial owner, and Legalization. From this point, you will be notified if any of the above has expired or is approaching the expiration date, and you can also navigate to the appropriate section of the channel for review by clicking on any of the items or selecting 'More details.'

Below, you will also find the 'Business Limits' option, where you can quickly access the transaction limits page.

In the 'User Information' section, you can stay informed about the expiration status of your password, as well as authorizations for linking accounts from other banks. By clicking on any of the items, you will be directed to the appropriate management page.

You can check your user accesses and limits from the 'Profile' section under 'User Accesses and Limits', where a) a summary of your basic details, and b) detailed transaction limits are included.

a) Your basic user details include: name, category, number of signatures, mobile number for OTP code delivery, general entry limit, and general approval limit.

b) Transaction limits include: general entry limits, which is the maximum amount that can be entered in a transaction by the submitter, and similarly, general approval limits, which is the maximum amount that can be approved by the approver. Specifically, each of these general limits includes individual general and special entry and approval limits for each type of transaction (payment, transfer, stocks, product management – acquisition, business financing, etc.).

Additionally, you can view the business limits from the Profile section.